CAP Table Explained

Understand startup valuations, shares, convertible instruments, and market value

Read Time: 8 mins

This week I’m in Switzerland for Hacksummit. As you may know, I invest in seed stage climate tech startups so I’m excited to meet new Founders and Investors and see how we may collaborate. 🫱🏼🫲🏾

With that in mind, I thought today we’d go over some startup finance basics.

A term you’ll often hear whether you are a Founder, VC, or Angel Investor is “Cap Table.” In fact, even as a tech employee, you’ll want to understand the cap table so you know how your options are determined and what they’ll be worth if the company exits or goes public.

“Who owns what?”

As your company grows, you’ll start issuing all different kinds of equity ownership — either shares or rights to ownership. This goes to people involved in the business like employees, investors and advisors.

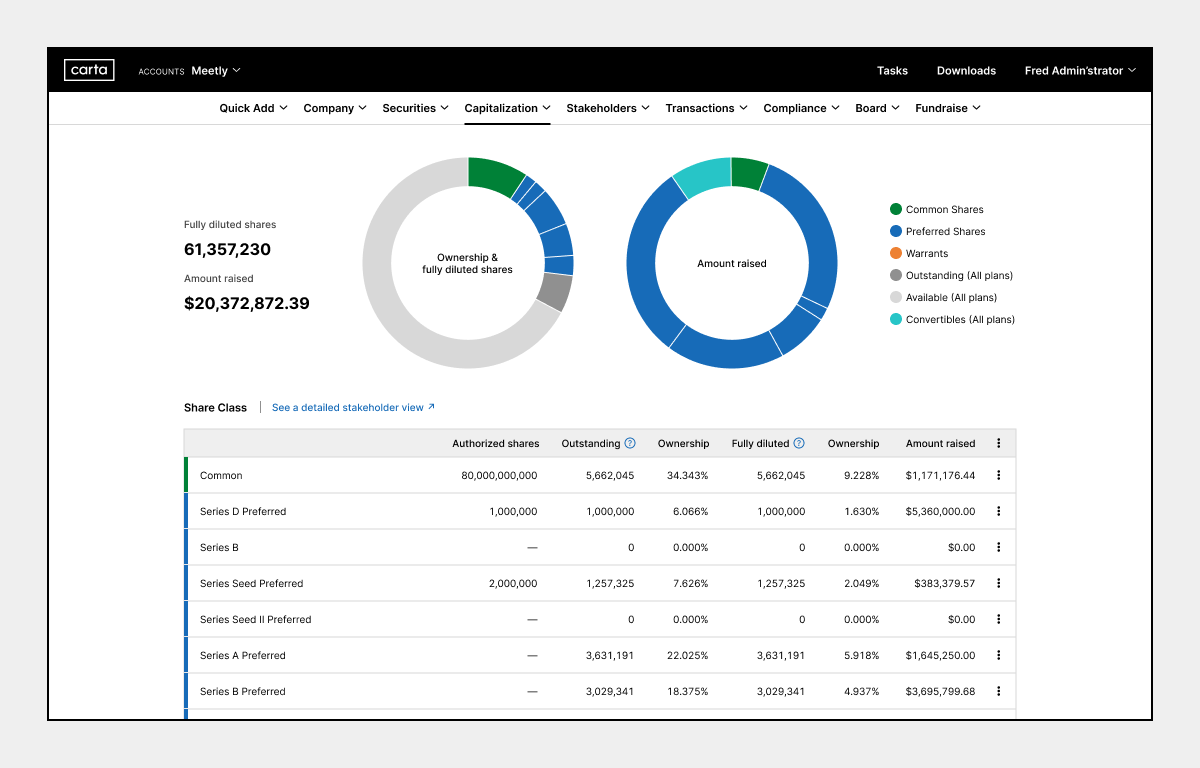

The shares given out will have different types of rules. While some Founders may start casually with a spreadsheet, there is some great software out there, which is probably going to make more sense as you scale. Carta is a common one.

What is a Cap Table

A cap table (capitalization table) is a critical document that tracks ownership in your startup. It should be created when you legally incorporate your company and serves as the single source of truth for equity ownership. 💵

When to Create Your Cap Table

When you incorporate, you'll declare how many shares to create - typically around 10 million shares according to Carta. Initially, these shares are usually split between co-founders (common splits are 50-50, 55-45, or other arrangements based on contribution).

What Your Cap Table Tracks:

Ownership percentages of all shareholders

Value of shares and their classes (common, preferred)

Vesting schedules for founders and employees

Option pools for future employees

Investment rounds and dilution history

How and when people can receive shares and how they'll pay for them

To create your cap table, you can make it yourself or hire a lawyer. However, keep in mind as your company grows, you'll need to graduate from spreadsheets to more robust solutions that can handle complex scenarios like option grants, conversions, and financing rounds — a DIY spreadsheet just won’t cut it anymore. 😝

Ownership Rights

Types of Shares

Share price is determined at the time shares are granted.

Common shares - Typically split among co-founders (the "vanilla" equity)

Preferred shares - Come with special privileges for investors, giving them first dibs on payouts whether you IPO gloriously or get acquired. They are first in line to be paid out if the company goes bankrupt and liquidates assets.

Other Key Terms

Stock options - Give employees the right to buy shares at a predetermined price (like a "rain check" for equity)

Participating shares - When preferred shareholders get to double-dip: first in line for payouts AND extra returns (2x, 3x) before common shareholders see a penny

Term Sheet - The investor's "prenup" outlining share preferences and rights (read the fine print!)

Convertible Instruments

This is for raising money when you don’t know how much a share is worth yet. Perfect for early-stage financing and faster negotiations.

Convertible Notes - Like an IOU with benefits: money + interest converts to equity upon a trigger event (funding round or maturity date). Comes with a discount and valuation cap.

SAFEs (Simple Agreement for Future Equity) - Not debt, just a promise to convert investment at the next round with no interest or maturity date. May include "most favored nation" status (if another investor gets better terms, the first investor expects these terms as well).

⚠️ A Note on Convertibles

Convertible notes aren't free money! Whether or not you raise a priced funding round, you must pay back the investor. When the maturity date hits, be prepared to either convert to equity, negotiate an extension, or face potential legal action. If you can’t convert into equity on the date, the investor could agree to a later date OR sue you. ☠️

⚠️ A Note on Dilution

Dilution is a reduction in ownership percentage for any individual investor caused by more investors entering the cap table. Every time new investors join, everyone's slice of the pie gets thinner. 🍰 Even convertible instruments represent future dilution—they've essentially called "dibs" on pieces of your company. The cap table doesn't lie: more investors = smaller founder piece.

Organizing the Cap Table

Equity Types

Different types of equity come with different rules. You have actual shares and convertible instruments, which allow for shares at a later date. Stock options are also NOT shares. They enable employees to buy shares at a later date, however, their price is locked in.

Vesting 101

Your cap table also tracks your vesting schedule. Vesting exists to incentivize employees to stay around and help your company be successful.

Your cap table tracks vesting schedules that keep talent committed:

Time-based vesting (most common): Typically 4 years with a 1-year cliff (25% after year one, then monthly/quarterly thereafter)

Milestone-based vesting: Equity unlocks when specific company goals are achieved

When you "exercise options," you're buying shares at your promised strike price (e.g., $1/share), regardless of current value. Fully vested = access to 100% of your promised equity.

Buying is optional!

Note: When employees don’t buy shares, they expire and get put back into the option pool.

Public Company Employees Receive RSUs

On the other hand, if you’re at a public company, this looks different. You may receive RSUs (restricted stock units). This is stock-based compensation issued by an employer. For example, at Zendesk I got 25% after 1 year and then the remaining 75% month to month over a 4 year period. So at 4 years, I would have received 100% (had I stayed 😄).

Good to Keep in Mind for Founders

*Specific to US market — Check your local regulations for similar requirements.

Rule 701

If you go over $10 million in equity compensation in a 12 month period, the SEC requires you to do a 701 disclosure. This is expensive and requires legal help. Best to avoid it by keeping track of your cap table.

FMB (Fair Market Value) & 409a Valuations

This determines your common stock price through an independent valuation. There are 3 key methods used:

Market approach: Based on investor pricing of shares in a recent round

Income approach: Revenue, cash flow, and expected future cash flow

Asset approach: Net asset valuation (such as equipment) for pre-revenue/pre-funding companies

These valuations aren't just paperwork—they set option prices and help avoid tax headaches for everyone.

Your Cap Table is Your Story ✨

Your cap table tells the complete financial story of your company—who owns what, who's owed what, and how value will be distributed in both success and failure scenarios.

While it might seem like just another “task” in the early days, it quickly becomes one of your most scrutinized documents during fundraising, acquisitions, and strategic decisions. Invest the time to get it right, update it, and understand the implications—your future self (and your investors) will thank you. 🫡

The Essential Bytes

→ Start Early, Stay Organized: Create your cap table at incorporation and graduate from spreadsheets to specialized software as you grow to properly track ownership, valuations, and vesting schedules.

→ Understand Your Equity Types: Different instruments (common shares, preferred shares, options, convertible notes, SAFEs) come with different rules, rights, and consequences—know what you're offering and receiving.

→ Mind the Dilution: Each new investor or equity grant reduces everyone's percentage ownership—plan your option pools and funding rounds strategically to maintain appropriate founder and employee stakes.

→ Stay Compliant: Regular 409a valuations set your fair market value for options, while monitoring Rule 701 thresholds ($10M in equity compensation) helps avoid costly SEC disclosure requirements.

Your Next Step

Feel ready to raise $$$ for your next startup or engage in a negotiation for stock options? 🙌 Comment your thoughts and recommendations for others. 💬

This Week’s Byte Sized Content 🎥

Building and Scaling Startups with Jodi (linkedin)

A Sure Way to Fail (tiktok)

3 Ways We Can Co-Create ✨🔮

Startup Advising

If growth design resonates with you, I advise select climate tech founders. My insights are most valuable for those ready to deepen customer discovery, design validation experiments for PMF, and build growth models. Apply here.

Growth Design Fundamentals

Hundreds of thoughtful technologists have found value in my approach to Conscious Growth Design. If you're curious about growth principles, building a sustainable future, and how to apply growth to your work, this free 5-day experience offers a glimpse into my comprehensive course.

Conscious Product-Led Growth Immersion

When teams at Uber, Ikea, and Adobe recognized the need for more conscious growth approaches, they invited me to share the frameworks I've developed for a decade in the field. You can get it here. If your team would benefit, message team@conscioustech.com to explore how a private workshop would serve your needs.

Get the Audio below ⬇️

Want audio? Become a paid subscriber for full access. Appreciate your support for this newsletter. 🤙

Keep reading with a 7-day free trial

Subscribe to Conscious Tech to keep reading this post and get 7 days of free access to the full post archives.